Back to Impact Studies

TM Investment Group: AI-Powered Deal Sourcing

Revolutionizing real estate investment through intelligent opportunity identification and automated market analysis

Lead Identification Rate

8.7%

Qualified Opportunities

327

Deal Flow Increase

185%

ROI

3.8x

The Challenge

TM Investment Group faced significant obstacles in scaling their real estate investment operations:

- Manual monitoring of thousands of daily Facebook investment group posts

- Delayed responses resulting in lost investment opportunities

- Inefficient extraction of property manager and agent information

- Limited ability to systematically analyze Redfin listings

- Valuable team time wasted on manual research

- Difficulty identifying subtle signals of motivated sellers

The Solution: AI Deal Sourcing Ecosystem

Facebook Group Opportunity Mining

- • Targeted group scraping across major investment networks

- • Intent-based AI analysis of posts and comments

- • Real-time alerting system

- • Comprehensive data collection and integration

Investment Platform Contact Extraction

- • Platform-specific data collection tools

- • Geographic targeting and filtering

- • Automated contact enrichment

- • Structured organization system

Redfin AI Market Intelligence

- • Automated listing monitoring

- • Undervaluation detection algorithms

- • Pattern recognition for motivated sellers

- • Investment criteria matching

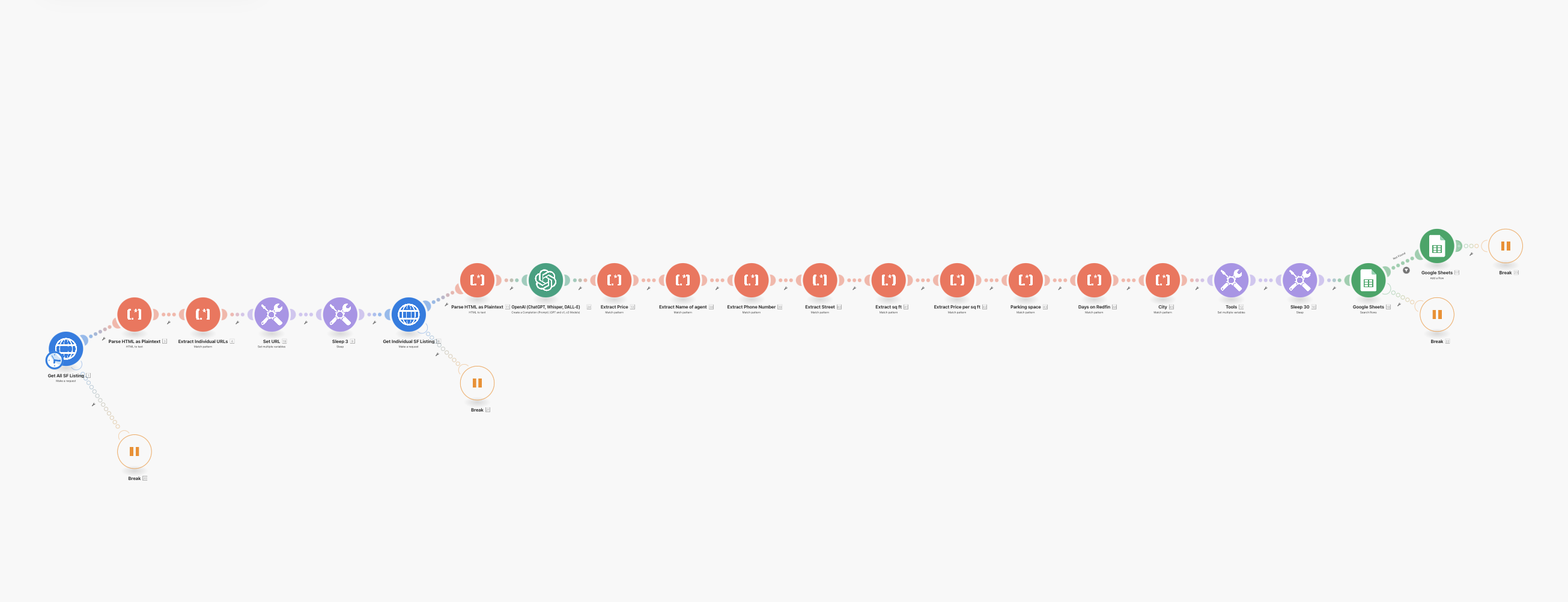

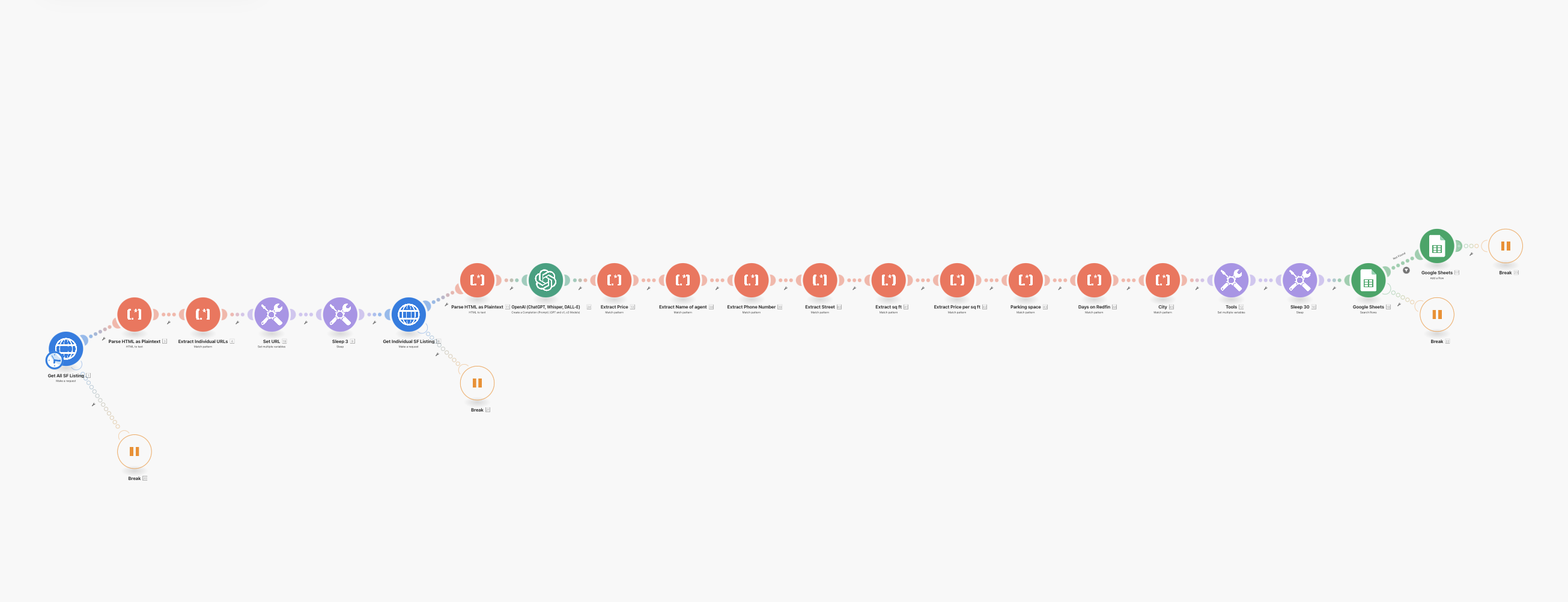

System Architecture

Comprehensive workflow diagram of the Redfin AI Scraper system

Results & Impact

- • 8.7% actionable opportunity rate from social media monitoring

- • 327 qualified investment leads in first three months

- • 185% increase in deal evaluation pipeline

- • 76% reduction in manual lead research time

- • 4-5 successful transactions per 200 prospects

- • 65% faster response time to opportunities

- • 23% lower acquisition prices through AI-identified deals

Key Insights

The TM Investment Group project revealed several valuable insights about real estate investment deal sourcing:

- • Information advantage creates negotiating leverage: Being first to identify motivated sellers often matters more than available capital

- • Pattern recognition outperforms manual analysis: AI systems can detect subtle signals of motivation across thousands of listings that humans would miss

- • Speed-to-contact drives conversion: Being the first investor to contact a motivated seller dramatically increases closing probability

- • Multi-source approach maximizes opportunity: Combining social media, investment platforms, and listing site data provides a comprehensive view of the market

- • Automation multiplies team capacity: Eliminating manual research allows investment teams to evaluate significantly more deals without adding headcount

"Thanks to Space & Miller, our workflow has become so much more efficient. Their AI tools take care of data collection, saving us hours each day, and the quality of leads we get is consistently high."

Marc Del Priore

President of TM Investment Group

Future Developments

- • Predictive analytics for early distress detection

- • Automated personalized seller outreach

- • Integration of additional data sources

- • Advanced opportunity filtering

- • Comprehensive performance analytics